Report: The Surprising Truth About Finding Clients

An Analysis of Independent Consultant Business Growth Strategies

I've been curious about how other independent consultants in our field find and keep clients. So we ran a survey! The results were interesting to me, and I think you'll find them useful, too.

I heard from consultants across experience levels, from newbies to veterans with 10+ years in the field. They work in strategic planning, fundraising, marketing, digital tech, and more. Their annual revenues range from under $50k to over $250k. You can see all the topline data points at the very end.

If you haven’t taken the survey, please do! We’ll update this report periodically with fresh data and insights. If you have, THANK YOU!

What Actually Works?

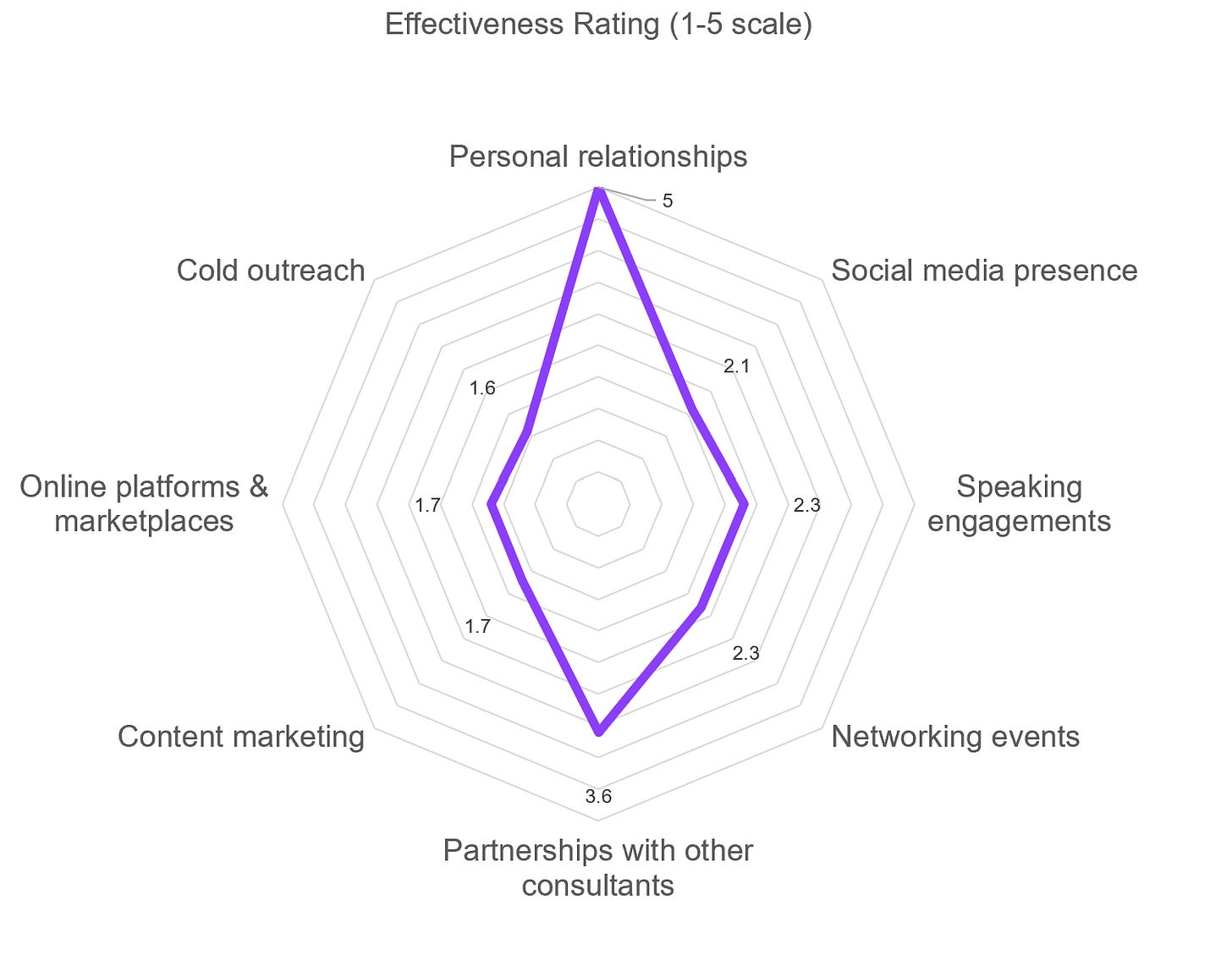

When asked to rank business development strategies, consultants rated personal relationships and word-of-mouth as most effective. Partnerships with other consultants came in second.

Speaking engagements and networking events received moderate ratings. Cold outreach, online platforms, and formal referral programs ranked lowest.

Most consultants report a sales cycle of 2-4 weeks (40%) or 1-3 months (50%). Only 10% experience longer cycles. I think these relatively shorter sales cycles reflect the sources of most of our work. That is, if you're building your business through personal relationships, it's logical to me that the sales cycle would be shorter than an RFP or cold outreach.

It's All About Who You Know

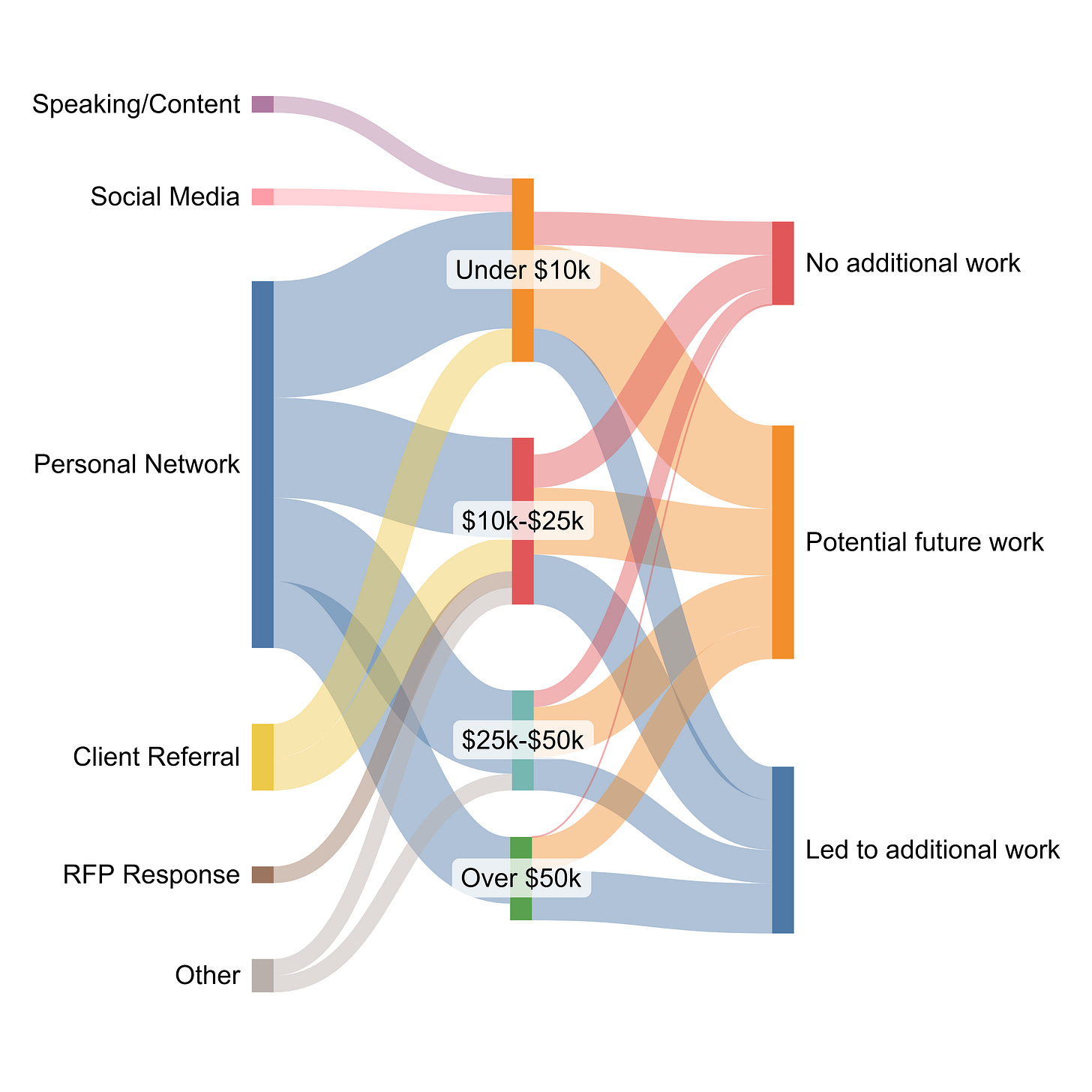

No surprise here, but the data confirms it: about 80% of client engagements come from personal networks. Most consultants rely on relationships they've built over time.

It's always been relationship based, drawing on folks I've worked with in the past.

Professional colleagues send the most referrals, followed by existing clients. Very few consultants find work through RFPs, social media, or speaking gigs.

The Referral Multiplier Effect

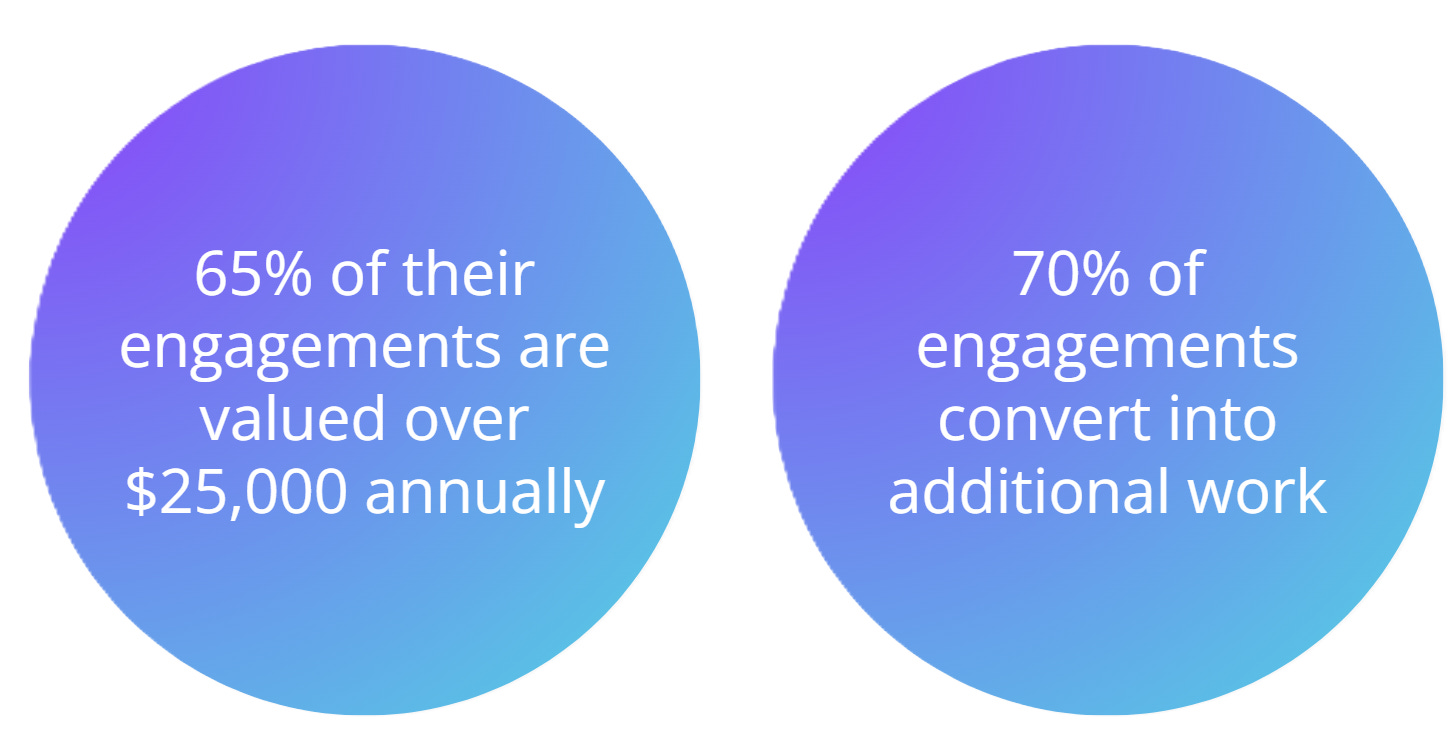

Not all referrals are created equal. The data shows that professional colleague referrals tend to lead to higher-value engagements than those from family or friends. But perhaps more importantly, there's a clear "referral chain" effect visible in many consultants' experiences. One successful engagement from a professional referral often leads to client referrals for additional work.

Consultants who reported "Previous/existing client" as referral sources typically have more engagements overall, suggesting that successful client relationships create a multiplier effect. This compounds the value of each new client relationship beyond its immediate revenue potential.

This multiplier effect highlights the importance of not just doing good work, but ensuring clients understand the full range of your services. Several consultants mentioned that initial projects often expanded into different service areas as clients became more familiar with their capabilities.

You can bring bring this insight to life for your business using the approach we detailed in a previous newsletter I wrote with my friend Kent Peterson. Check it out here:

How We Structure Our Work

The data shows we use a mix of contract types. A plurality use project-based fees, while monthly retainers and hourly rates each account for about 30% of engagements.

Most engagements last 3-6 months, though about a quarter are described as "ongoing." Finding stability through longer-term relationships rather than constantly hunting for new projects seems logical to me. It's definitely how I've approached building my business.

Contract values vary widely. About 30% of engagements bring in under $10k annually, another 30% between $10k-$25k, 25% between $25k-$50k, and 15% above $50k.

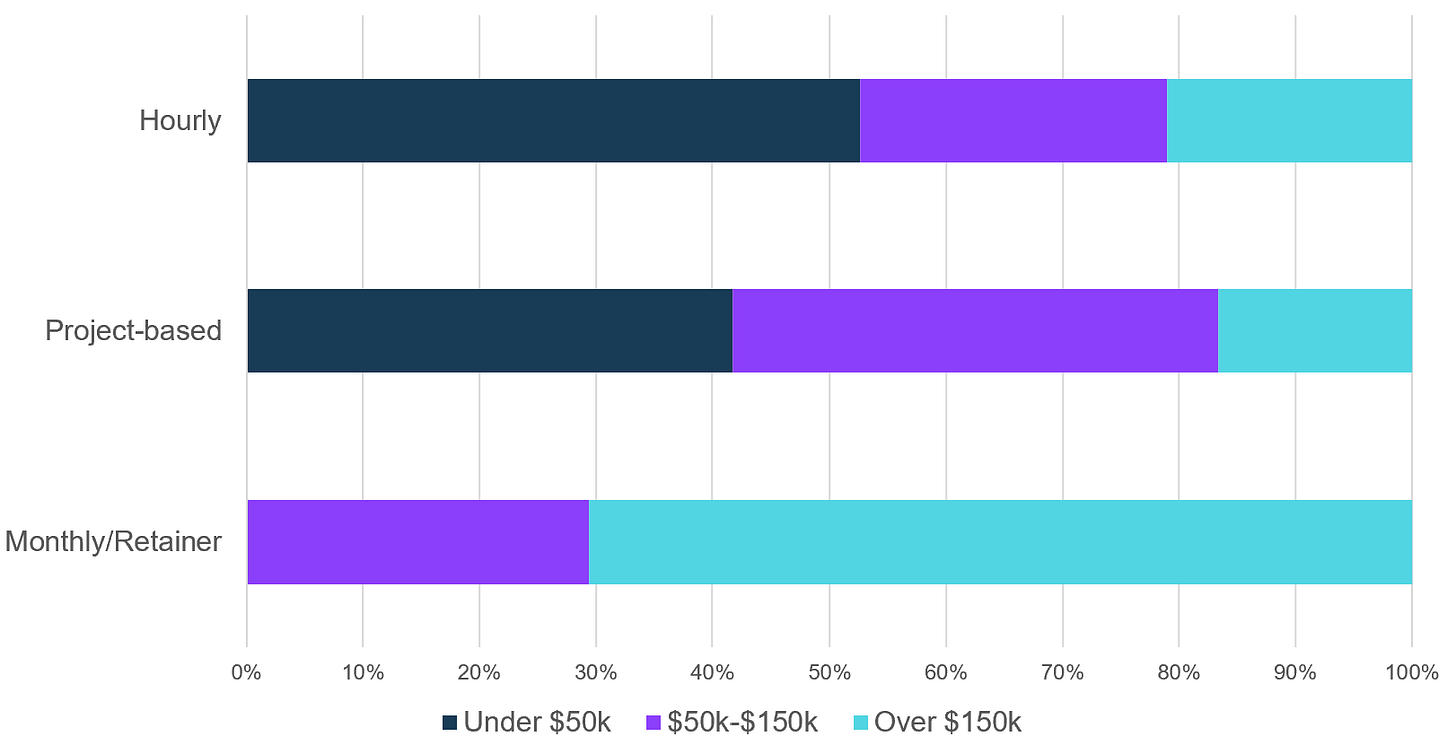

Contract Structures That Work

The data reveals interesting patterns about which contract structures correlate with higher revenue. Consultants earning over $150,000 annually tend to favor retainer and monthly fee arrangements over hourly rates. Similarly, the highest-value engagements (those exceeding $50,000 annually) are predominantly structured as retainers or monthly fees rather than hourly or project-based arrangements.

There's also a correlation between contract type and engagement length. Project-based fees dominate shorter engagements (3 months or less), while monthly fees and retainers are more common for longer-term relationships. This suggests that how you structure your contracts may influence not just your immediate revenue but the longevity of your client relationships.

Sector-Specific Success Patterns

Different consulting specialties show distinct patterns in how they secure and structure client work. Fundraising and development consultants appear particularly successful at establishing retainer-based arrangements, creating more predictable revenue streams. Strategic planning consultants typically command higher fees but for shorter durations, creating different pipeline management challenges.

Consultants offering multiple service areas (three or more specialties) demonstrate greater diversity in both engagement types and sources.

This versatility appears to create natural opportunities for extending client relationships across different needs and project types.

The data suggests that understanding the typical engagement patterns in your specialty area can help you set appropriate expectations and develop business development strategies tailored to your niche. It also highlights the potential value of expanding your service offerings strategically to create natural extension points with existing clients.

The Power of Repeat Business

I see it as a great sign that 40% of engagements led to additional work with the same client. Another 35% were described as "likely to lead to future work." Only 25% definitely didn't lead to more work.

Investing in client relationships pays off. One consultant shared:

I tend to choose clients who want ongoing support who I respect and want to work with on the long term; develop trust, and stick with them if they'll have me.

The data backs up this approach. Building deeper relationships with fewer clients might serve us better than constantly chasing new ones.

The Value of Long-Term Client Relationships

Consultants who establish longer initial engagements (6+ months) are significantly more likely to develop ongoing client relationships. Consultants reporting "ongoing" engagements also consistently show higher annual revenues, suggesting that relationship continuity directly contributes to financial success.

The data shows that converting smaller initial engagements into ongoing relationships is a critical success factor, more effective than constantly pursuing new clients.

Several higher-earning consultants explicitly mentioned prioritizing relationship quality over quantity, focusing on fewer deep client relationships rather than many transactional ones. This approach creates both stability and the opportunity for expanded work over time.

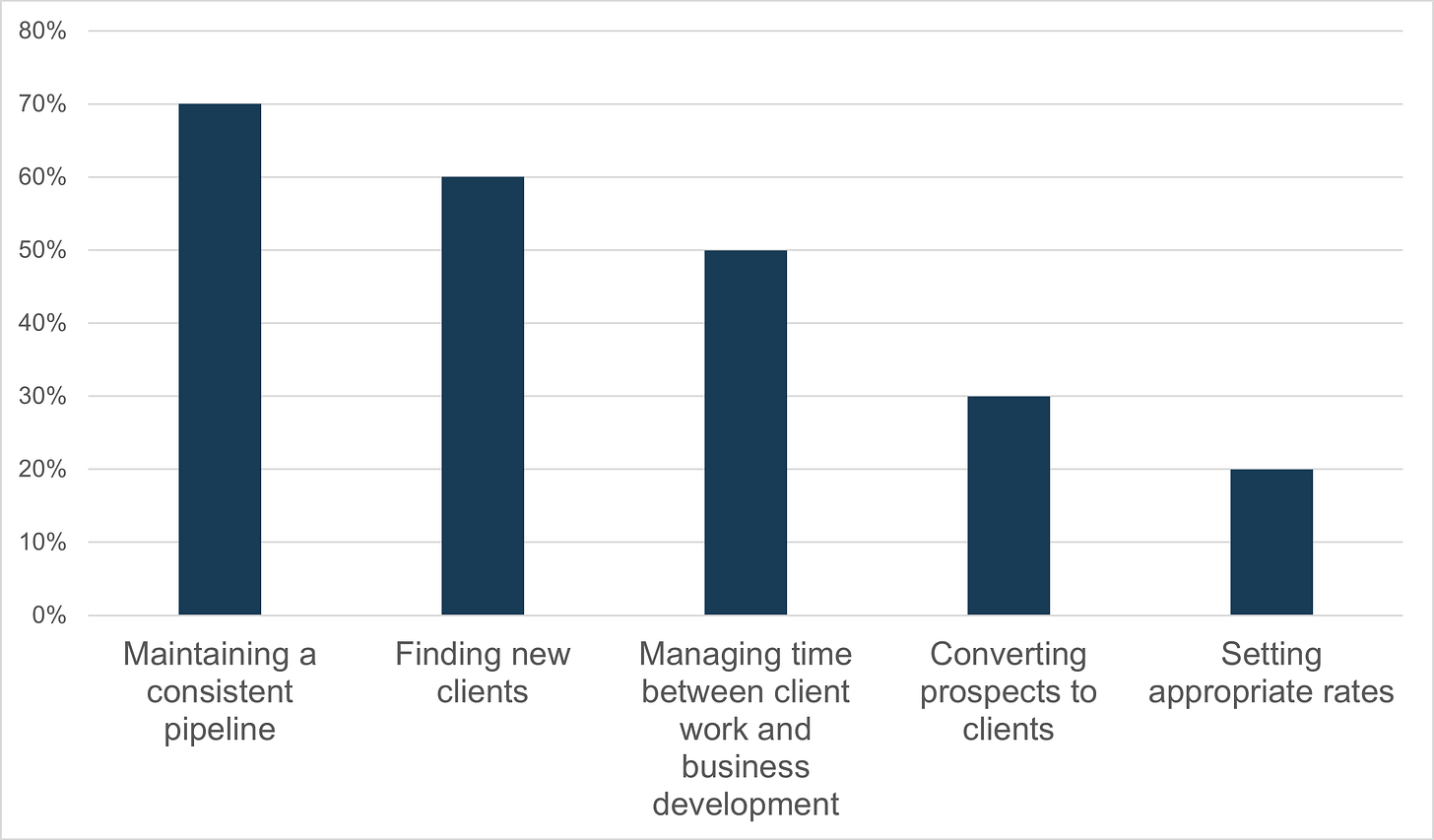

Our Biggest Headaches

The challenges sound familiar to me, and probably to you too:

70% struggle with maintaining a consistent pipeline. 60% find it hard to discover new clients. 50% struggle to balance client work with business development. 30% have trouble converting prospects to clients. 20% worry about setting the right rates.

One consultant captured the dilemma perfectly: "I've never done anything active beyond building a website and having a LinkedIn profile -- and then trying to be wildly helpful to anyone I come across in the field... BUT that is also very stressful because while I've always hit my revenue targets, there are too many moments when I'm not sure it's going to happen."

I feel that in my bones. The feast-or-famine cycle wears on us.

What Consultants Earning Over $150,000 Per Year Do

Our data reveals distinct patterns among consultants who consistently earn more than $150,000 annually. These high-earning consultants approach their business development and client relationships in ways that set them apart from their peers.

Higher-earning consultants focus on quality over quantity when it comes to client engagements. They typically secure fewer but higher-value contracts, with many reporting engagements valued at $25,000-$50,000 or over $50,000 annually. Rather than juggling numerous small projects, they cultivate relationships with "anchor clients" that provide stable, substantial revenue.

Contract structure also distinguishes top earners. Retainer and monthly fee arrangements dominate their client portfolios, creating predictable revenue streams and ongoing relationships rather than short-term project work. This approach not only stabilizes income but creates natural opportunities for expanding services over time.

Personal networks remain the lifeblood of business development for these consultants, with virtually all citing their existing relationships as their primary client sources. Professional colleague referrals are particularly important, suggesting that peer recognition plays a significant role in accessing higher-value opportunities.

These consultants invest significant time in relationship cultivation rather than transactional business development. Many actively partner with other consultants, creating mutual referral ecosystems that expand their reach without requiring cold outreach or formal marketing efforts.

Interestingly, many top earners offer multiple service areas rather than a single specialty, allowing for cross-selling and expanded engagements with existing clients.

Perhaps most importantly, higher earners demonstrate exceptional client retention. They focus on developing long-term client relationships rather than constantly seeking new clients. Many structure initial engagements specifically to create opportunities for expanded work, viewing each new client as a potential long-term partner rather than a one-time project.

What We Want Help With

When asked about desired support, collaborative opportunities with other consultants emerged as the dominant request, cited by approximately 70% of respondents. This strong preference for collaboration suggests many consultants recognize the value in joining forces with peers who have complementary skills or networks, whether through formal subcontracting arrangements or looser referral partnerships.

Beyond collaboration, consultants expressed significant interest in practical tools to streamline their business development, with about half seeking proposal templates and similar resources. This suggests many struggle with the mechanics of converting prospects into clients and desire proven frameworks to make this process more efficient. Market intelligence also emerged as a key need, with 40% of consultants seeking better information about pricing and rates.

The data also reveals a strong desire for structured networking opportunities specifically with other consultants (cited by 40% of respondents). This differs from general industry networking and suggests consultants are looking to build peer communities for mutual support, learning, and potential collaboration. Interestingly, while many identified maintaining a consistent pipeline as their biggest challenge, relatively few explicitly requested training on sales techniques.

These expressed needs point to consultants seeking both community and structure - ways to connect with peers while developing more systematic approaches to business development.

A main purpose to this Substack is to create and share resources. Here are a few we’ve already published:

Biz Dev Basics for Independent Consultants - Straightforward approaches for growing your practice without feeling inauthentic or uncomfortable here.

Biz Dev Startup Checklist - Essential groundwork that makes authentic client conversations more effective here.

Proposal Guide & Template - A practical approach to writing effective proposals here.

Proposal Template - Downloadable template to streamline your proposal process here.

What This All Means

The data reveals both strengths and limitations in how we approach business development.

Relationship-based approaches build trust and lead to meaningful work. But they also create a growth ceiling based on network size and make us vulnerable to network changes.

Few of us use content marketing or thought leadership despite their potential to build credibility. Most don't systematically cultivate referrals. Collaborative partnerships show promise but remain underutilized.

Revenue Concentration: Risk and Opportunity

The survey reveals an important pattern in how consultants structure their client portfolios. For most consultants, 1-2 key engagements represent the majority of their annual revenue. While this creates stability when those relationships are strong, it also introduces vulnerability if those key clients reduce their needs or budgets.

Consultants reporting more consistent pipelines typically maintain more diverse engagement values with a mix of small, medium, and large contracts. Several consultants with annual revenues exceeding $150,000 specifically mentioned maintaining a mix of high-value "anchor" clients alongside smaller supplementary engagements.

Consultants offering multiple service areas (three or more specialties) tend to have more diverse engagement types and sources. This versatility appears to create natural protection against revenue concentration risks while opening more opportunities for cross-selling services to existing clients.

The data suggests that while focusing on fewer, deeper client relationships is generally effective, maintaining some diversity in client size and service needs provides important stability and growth potential.

Where Do We Go From Here?

Based on the data, I see three opportunities:

First, we can systematize our relationship management. Create tracking systems for network contacts. Develop approaches to nurture existing client relationships. Implement formal referral processes.

Second, we can build more collaborative partnerships. Find complementary consultants for project sharing. Explore referral arrangements. Consider forming loose collectives to expand capacity.

Third, we can create sustainable business development habits. Schedule dedicated time for business development, even during busy periods. Develop minimum viable practices that maintain consistency. Focus on activities that align with our strengths.

What resonates with you from these findings? How do you approach building your client roster? Hit reply and let me know - I'd love to hear your perspective.

Until next time,

Sam

Survey Methodology

This report is based on survey data collected from independent consultants working in the nonprofit and social impact sectors. The survey captured a diverse range of consultant profiles and experiences:

Respondent Demographics

Experience Level:

30% with 3 years or less experience

50% with 4-10 years experience

20% with more than 10 years experience

% of Respondents Who Listed These Consulting Focus Areas:

40% Strategic Planning

30% Marketing/Communications; Fundraising/Development

20% Digital/Technology; Talent/HR; Coaching/Staff Development

10% Financial Management/Budgets; Policy/Advocacy; Program Evaluation

Annual Revenue:

20% under $50,000

30% between $50,000-$150,000

50% over $150,000

Client Engagement Volume:

40% reported 1-5 paying client engagements in the past 3 years

30% reported 6-10 engagements

20% reported more than 20 engagements

10% reported 11-20 engagements

Breakdown of Types of Engagements

Based on the data from independent consultants in the social impact sector, here's a breakdown of the types of client engagements:

Contract Types

Project-based fees: Approximately 35% of engagements

Monthly fee/retainer arrangements: Approximately 30% of engagements

Hourly rate contracts: Approximately 30% of engagements

Other contract types: Approximately 5% of engagements

Engagement Duration

3 Months or Less: Significant portion of short-term projects

3-6 Months: Most common duration range

6-12 Months: Moderate representation

More Than 1 Year: Less common but present

Ongoing: Approximately 25% of engagements have no defined end date

Engagement Value (Annual)

Under $10,000: Approximately 30% of engagements

$10,000-$25,000: Approximately 30% of engagements

$25,000-$50,000: Approximately 25% of engagements

Over $50,000: Approximately 15% of engagements

Client Continuation Patterns

Led to additional work: Approximately 40% of engagements

Potential future work ("not yet but likely"): Approximately 35% of engagements

No additional work: Approximately 25% of engagements